washington state capital gains tax vote

Washington Voters to Weigh in on New Capital Gains Income Tax October 25 2021 Jared Walczak On May 4th Gov. Engrossed Substitute Senate Bill 5096 sponsored by Sen.

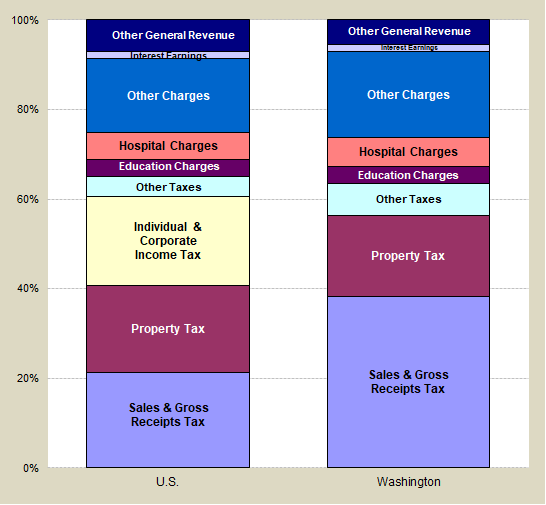

State Local Government Revenue Sources Office Of Financial Management

State Measures Advisory Vote No.

. The sponsor filed multiple versions of the initiative and some versions contain different provisions. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan. But it was thrown out by the state Supreme Court a year later which pointed to the state constitution.

I honestly think he is the only one who gets anything done Mike Dunmire said. This initiative would repeal a 7 capital gains tax that was set to begin being collected in 2023. ESSB 5096 violates the uniformity and limitation requirements of article VII sections 1 and 2 of the Washington State Constitution.

The legislature imposed without a vote of the people a 7 tax on capital gains in excess of 250000 with exceptions costing 5736000000 in its. SEATTLE TIMES June 9 2006 Tues Oct 5th 2021. Voters in 38 of 39 Washington counties told the Legislature that they do not approve of the states new capital gains tax.

State Attorney General Bob Ferguson has since asked the state Supreme Court to take the case on direct appeal. An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov. It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold.

On Saturday the Senate narrowly passed legislation by a vote of 25-24 to establish a capital gains tax. Washington officials expect just 40 voter turnout in 2021 The Democrat-led Legislature approved the 7 tax on capital gains over 250000 in 2020 which is estimated to bring in over 400 million. OLYMPIA Washington voters were rejecting a state advisory measure to adopt a new 7 tax on capital gains above 250000 in Tuesday nights election results.

On November 2nd Washington lawmakers will learn what voters think about it. June Robinson D-Everett would establish a capital gains tax of 7 percent on capital gains that exceed 250000 in a given year. Jay Inslee in December is estimated to raise 875 million per year at a rate of 9 on stocks bonds and commercial real estate.

1 day agoThats in spite of Douglas County Superior Court Judge Brian Hubers March 1 ruling that the capital gains tax adopted last year Senate Bill 5096 is an unconstitutional graduated income tax. Capital gains tax passes House heads to Senate for concurrence Michael Goldberg April 22 2021 After several hours of debate the House passed the Senates capital gains tax bill Wednesday in a 52-46 vote bringing Democrats one step closer to rebalancing Washingtons tax code. Washingtons advisory votes are.

It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold. The bill now heads back to the Senate for final concurrence. The Associated Press OLYMPIA Profits on the sale of stocks and bonds in excess of 250000 would be subject to a new tax on capital gains under a bill narrowly approved Saturday by the Washington.

This measure would repeal a 7 excise tax on annual capital-gains above 250000 by individuals from the saleexchange of stocks and certain other capital assets the tax exempts real estate and. A graduated income tax was enacted by initiative in 1932 passing with about 70 of the vote. By contrast the capital gains tax proposed by Gov.

Voters will vote on capital gains tax advisory vote on it this year but to actually repeal it we need Jim Walshs I-1408 on Nov 2022 ballot. Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022.

This measure would repeal a 7 excise tax on annual capital-gains above 250000 by individuals from the saleexchange of stocks and certain other capital assets the tax exempts real estate and. Advisory Vote 37 is. In an advisory vote on this years general election ballot voters across the state said by a nearly 63 to 37 margin that the states new 7 capital gains tax should not be approved.

Senate Passes Capital Gains Tax.

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

A History Of Washington State S Tax Code All In For Washington

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Job Bell The Cat Capital Gain

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Challenge To Washington S Capital Gains Tax Can Move Forward Judge Rules The Seattle Times

In A Blow To Progressives Douglas County Court Strikes Down Wa S New Capital Gains Tax The Seattle Times

Your Only Chance To Opt Out Of Washington S New Long Term Care Tax Is Fast Approaching Puget Sound Business Journal

Judge Overturns Washington S New Capital Gains Tax The Columbian

Capital Gains Tax Rate Chasm Separates Trump Biden Wsj

Washington State Capital Gains Tax Update Attorney General Seeks Appeal To Reinstate Controversial Law Geekwire

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Wa Budget Policy Budget Policy Twitter

Washington State Kicks Off Major Tax Fight With New Capital Gains Levy The Hill

New State Laws For 2022 Expand Voting Rights Create Capital Gains Tax And More South Seattle Emerald

New Washington State Laws Going Into Effect In 2022 790 Kgmi

Washington State Considers Having Highest Sales Tax In The U S Tax Foundation

Federal Revenue From Capital Gains Taxes Fell Sharply During The Recession Down 100 Billion From 2007 To 2009 Rates Are Capital Gain Capital Gains Tax Gain